Benefit Analysis

Benefits Analysis Overview

Completing a benefits analysis involves making a phone call with a client to find out what benefits they are receiving and then completing an estimate on DB101. This provides individuals with an estimate of how work might impact their benefits. You will complete a couple of scenarios based on their estimated wage to see how that will impact their medical or cash benefits. This is done in the Plan Phase.

Many of the individuals we support are receiving medical or cash benefits. Medical benefits help provide them with medical coverage, whereas cash benefits help them pay for their living expenses. These benefits are partially dependent on an individual's income that they are currently receiving. It is important that we help the individual understand how work will impact their benefits so they can make an informed choice about work.

We should complete a benefits analysis when an individual is in the EDS-Plan phase, running a couple of scenarios based on their wage and scheduling preferences.

If a participant is in the Keep Phase, whenever an individual is anticipating a change in their wages or number of hours per week, we should also complete a benefits analysis. This will help them be prepared for any changes and make informed choices.

Important Information: We only do benefits analysis in the EDS-Plan Phase and Keep Phase.

Benefit Analysis Resources:

-

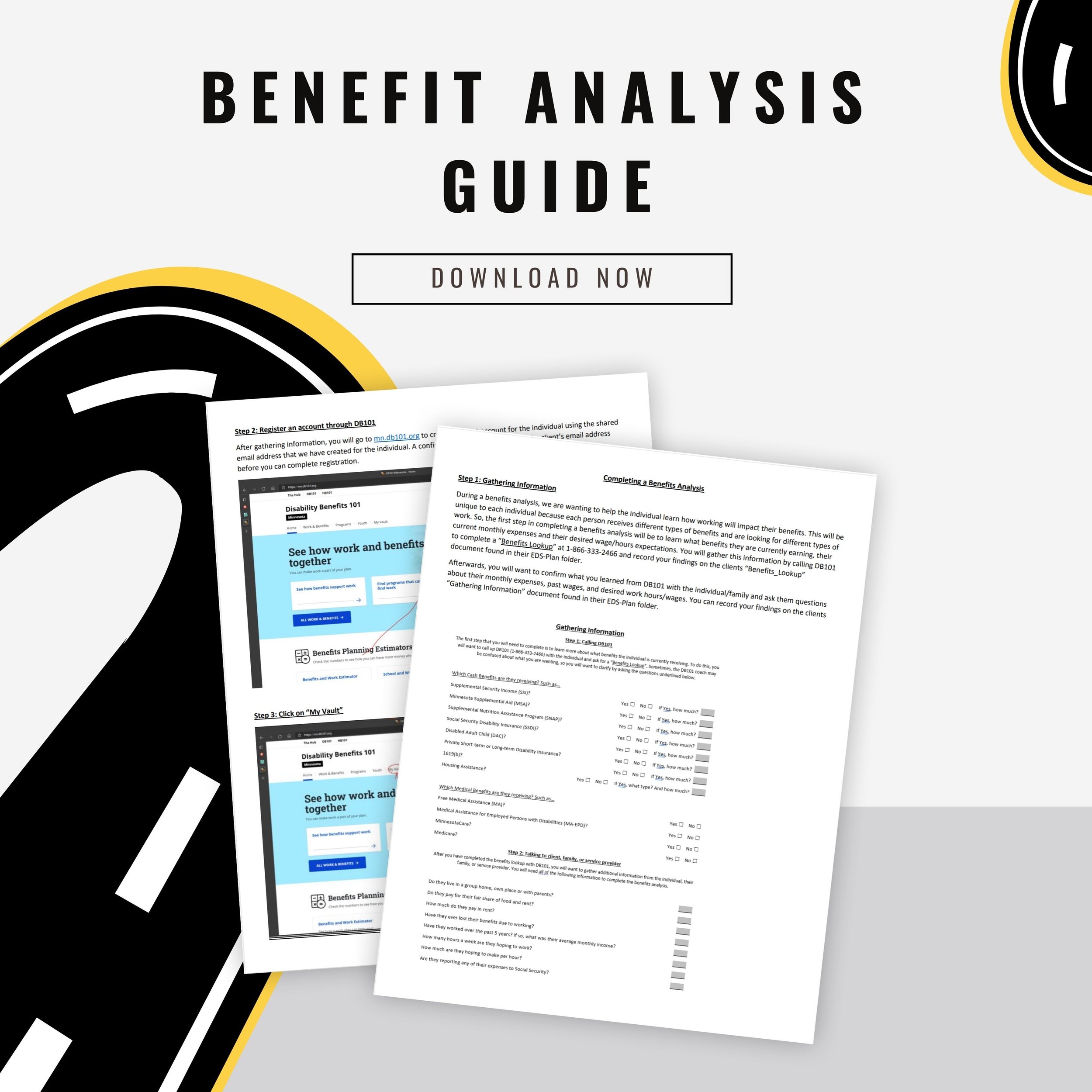

Benefits Analysis Guide

This is a step-by-step guide to run a benefits analysis.

-

Benefits Analysis Lookup Questions

This has a list of questions to ask and information to gather for a benefits analysis.

-

DB101

This is the general hub of disability benefits information for Minnesota. They are a great resource for benefits-related questions you may have! They have a chat line and a phone line that is open for benefit-related questions.

Benefits for individuals with disabilities and work

Common Participant Benefits

-

Supplemental Security Income (SSI)

What is SSI?

SSI is a program run by Social Security. If eligible for SSI, Social Security gives you money each month for food, rent, and utilities. Most people who qualify also get Medical Assistance (low-cost health insurance).Eligibility

Disability: long term, severe, and limits work

Low Assets: under $2,000 if unmarried / under $3,000 if married

Low Income (monthly): under $914 if unmarried / under $1,371 if married

How can your participant find out if they are receiving SSI?

Call Social Security at 1-800-772-1213 and ask.

-

Social Security Disability Insurance (SSDI)

What is SSDI?

SSDI is a monthly cash benefit for some individuals with disabilities. After they have been eligible for SSDI for 24 months, they will receive Medicare (a type of medical insurance). The amount earned monthly depends on the amount earned.

Eligibility

Disability: long term, severe, and limits work

Disability-Insured Status: If the individual works or worked, their employer takes a little bit of their wages and matches it in the social security trust fund for them. If they reach a certain amount of money, they are insured.

How can your participant find out if they are insured?

Call Social Security at 1-800-772-1213 and ask. Call the TTY number at 1-800-325-0778

-

Disability-Based Medical Assistance (MA)

What is Disability-Based Medical Assistance?

Medical Assistance helps pay medical expenses.

Disability-based MA is a way for individuals with disabilities to qualify for MA. It may let you get MA even if you make more money income-based MA allows. It may let you get MA and Medicare at the same time. It may cover additional services that income-based MA does not cover.

Eligibility

Disability: long term, severe, and limits work

Be a U.S citizen or have immigration status that qualifies for MA.

Assets: under or at $3,000 if single / under or at $6,000 for two family members (additional $200 limit for each family member)

Income (monthly): below $1,133 for a person / $1,526 for two family members

*If higher the participant can still be eligible, but may have to spend some money before coverage kicks in.

-

Medicare

Medicare is like a big piggy bank that helps pay for health care when people get sick. In Minnesota, there are different types of Medicare plans that help pay for things like going to the hospital or seeing a doctor. Some people have private plans that help pay for these things too. There are also special plans called Medigap policies that help pay for things that Medicare doesn't cover.

-

Income Based Medical Assistance

What is Income-Based Medical Assistance?

Medical Assistance helps pay medical expenses.

Eligibility

Under 65 years old (can be older if you are a caretaker of a child or pregnant)

No Medicare elligibility

U.S. citizen or eligible immigration status

Income Limit: $18,754 single / $38,295 for a family of four

-

Medical Assistance for Employed Persons with Disabilities (MA-EPD)

What is Medical Assistance for Employed Persons (MA-EPD)?

Medical Assistance helps pay medical expenses. People can get it and Medicare at the same time. MA-EPD covers more services than Medicare.

With MA-EPD, individuals with disabilities can work and still qualify for Medical Assistance.

If someone signs up for MA-EPD and their employer offers health insurance, they are required to sign up for the employer’s health insurance. MA-EPD may pay the individuals premiums if the health insurance is at a “reasonable cost.”

The premium amount depends on how much income a person makes.

Eligibility

Disability: physical or mental impairment or combination of and long term

U.S. citizen or eligible immigration status

Assets: below or at $20,000 (unlimited if under 21 or pregnant)

Benefit Analysis Communication Template

This is a simplified template that is optional to fill in that can help ensure that your client can make an educated choice. You place this on their EDS-Plan

[CLIENT] is currently receiving the following benefits:

[BENEFIT 1]

[BENEFIT 2]

…

[TOTAL MONTHLY INCOME]

If [CLIENT] works [X] hours per week, earning $ [X] per hour the following will happen:

[BENEFIT 1] is expected to [DESCRIBE OUTCOME]

[BENEFIT 2] is expected to [DESCRIBE OUTCOME]

…

With their work wages and benefits, their total monthly income will be approximately [TOTAL MONTHLY INCOME]

If [CLIENT] works [X] hours per week, earning $ [X] per hour the following will happen:

[BENEFIT 1] is expected to [DESCRIBE OUTCOME]

[BENEFIT 2] is expected to [DESCRIBE OUTCOME]

…

With their work wages and benefits, their total monthly income will be approximately [TOTAL MONTHLY INCOME]

After presenting these findings to [CLIENT], they have decided that they would like to work approximately [X] hours per week, earning no more than $ [X] per hour.

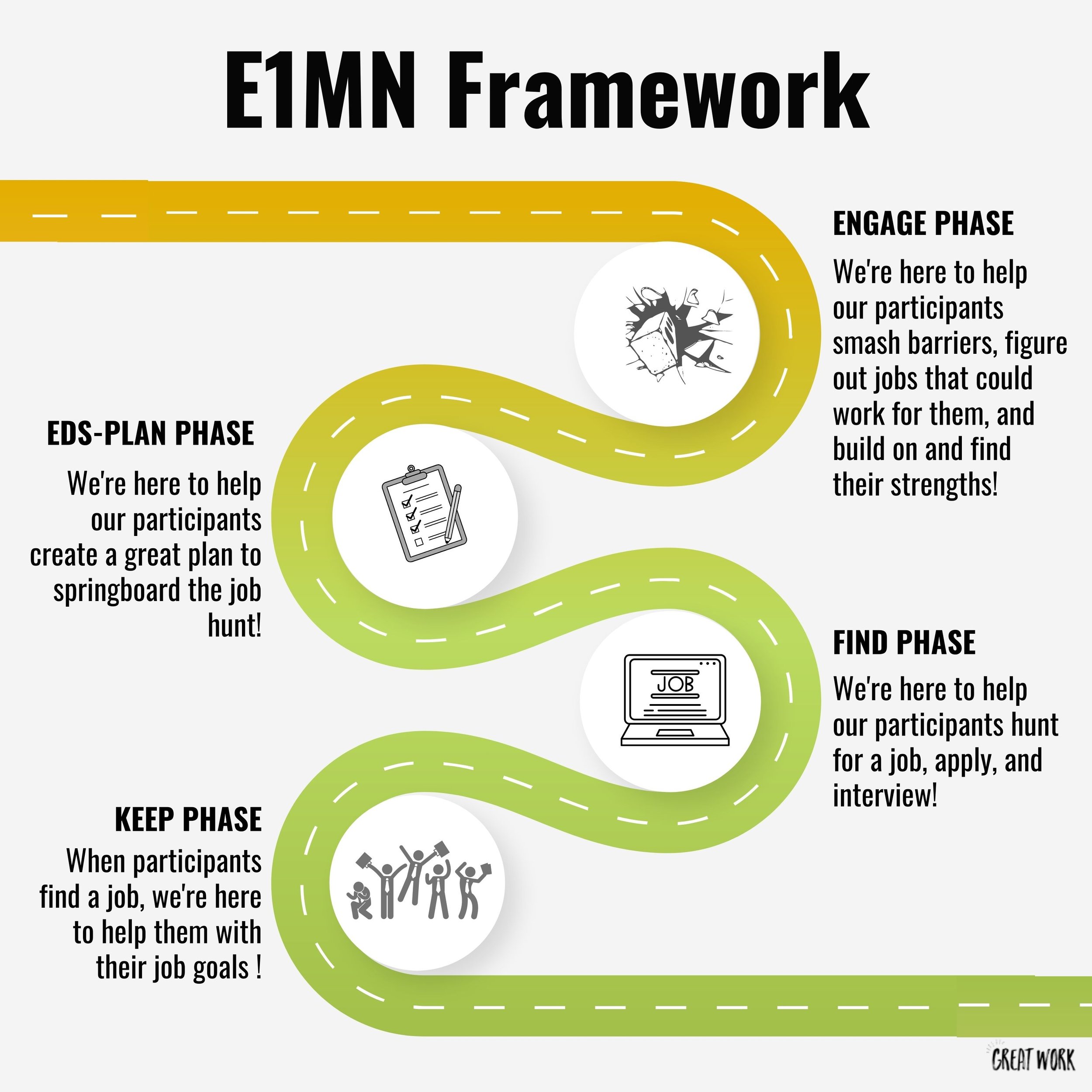

The E1MN Framework

The Employment First Minnesota Framework (E1MN) is designed to help make sure that Great Work helps our participants explore employment, plan for employment, find a job, and keep a job that is a perfect fit for them! Click below to learn more about each phase: